Warren Buffett Buys Into a Different Amazon

By Shira Ovide | Bloomberg

May 03, 2019 – Warren Buffett has repeatedly said he was an “idiot” for not buying stock of Amazon.com Inc. when the company was younger and its share price was lower. Now comes news that his Berkshire Hathaway Inc. plopped some shares of the e-commerce giant in its shopping cart, at a time when Amazon is shedding some but not all of the characteristics that made the Oracle of Omaha shun technology companies for years.

One investing lieutenant at Berkshire Hathaway—not Buffett himself, he stressed to CNBC—opted to buy Amazon shares for the firm in recent months, Buffett said on Thursday. He was very insistent that it wasn’t him doing the Amazon buying, perhaps because Buffett’s reputation as a lifetime proponent of value investing would be dinged by a purchase of Amazon stock.

This is a company, after all, that is valued at 50 times analysts’ average of earnings expected in 2020. By contrast, Berkshire’s other big bet on a technology giant — Apple Inc., which the firm has held since 2016 — is valued at 16 times by the same measure.

Amazon shares are definitely not a bargain, unlike the $41, nearly one-and-a-half-pound T-bone at Buffett’s favorite steakhouse. In 2014 and early 2015, when Amazon’s financial results were ugly and investors lost faith, that might have been a more Buffett-like time to buy. Its stock market value has gained a stunning $800 billion since that time. To be fair, Amazon shares weren’t inexpensive even in 2014 on a multiple of earnings.

Still, Amazon is showing more Buffett-ish characteristics. It’s not going to turn into a “cigar butt” stock that the investing idol loves, but by Amazon standards the company is getting less turbocharged by growth and more obsessed with profits. Whether that’s a good thing for Amazon investors other than Berkshire Hathaway is debatable.

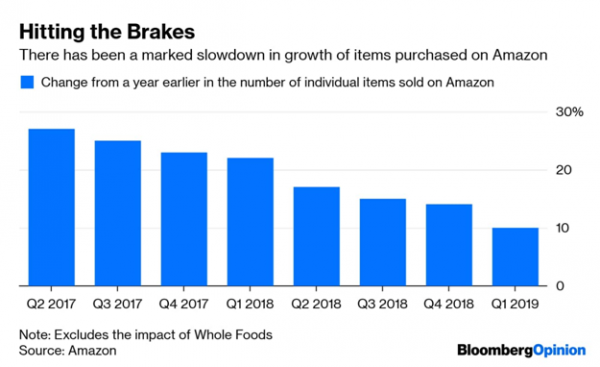

On the growth front, it’s c lear that Amazon’s main business in e-commerce has lost a step or two, and executives have offered lame explanations for the hiccups. In the first quarter, the number of individual items sold on Amazon’s online shopping malls rose 10 percent from a year earlier. The growth rate was 22 percent just one year earlier. It marked the second consecutive quarter in which Amazon’s e-commerce sales appeared to be growing not much faster than U.S. online sales overall.

At the same time, Amazon is getting relatively more profitable. I say relatively because Amazon is notorious for delivering decades of slim-to-no profits. But Amazon’s operating profit margin in the first quarter was a record — 7.4 percent, or a bit lower than Gap Inc.’s operating margin last year. Not swimming in profits, for sure, but hefty by Amazon standards. That doesn’t put Amazon in Buffett’s cheap and beaten-down territory, but it’s also not wildly unprofitable Uber.

That share of profit is likely to go down, at least this year. Amazon is set to spend $800 million in the current quarter — and who knows how much after that — as it works to shift the two-day standard shipping on deliveries to Prime members down to one day. Amazon executives also have said the company spent less than it expected on hiring in the first quarter, and that’s likely to increase in the latter part of 2019.

Amazon still isn’t a bargain. It’s a company more focused on profits in the last few years, but still not very profitable — and mostly by design. Amazon’s mix of businesses has shifted in such a way as its costs for products, or cost of goods, are declining more as a share of revenue than spending is increasing for shipping, package-delivery centers, employee salaries and other operating costs. Amazon, in short, has the power to control the level of profit it generates. It’s a great position to be in.

A less growth-charged, structurally more profitable Amazon might have been enough to attract the attention of Berkshire’s stock pickers. It remains to be seen whether that’s the Amazon most other investors actually want.