By Martin Weiss – Weiss Research

By Martin Weiss – Weiss Research

If you haven’t met my good friend Charles Goyette, now’s the time to do so.

He’s the author of the New York Times bestselling book, The Dollar Meltdown and the recent blockbuster release, Red and Blue and Broke All Over.

He’s frequently been on Fox News, CNN, MSNBC, PBS, CNBC and the Fox Business Channel — on shows with Bill O’Reilly, John Stossel, Judge Napolitano, Bill Moyers, Lou Dobbs and others.

Lew Rockwell, the chairman of the prestigious Ludwig von Mises Institute, says “Charles Goyette has been a rare beacon of freedom and common sense.”

And Congressman Ron Paul writes: “My friend Charles Goyette does a great job explaining why America faces a looming financial crisis and outlines common sense strategies for individuals to protect themselves and their families.”

These endorsements are impressive. But what’s even more impressive are his credentials in helping investors make money.

Before the great gold and silver bull market of the late 1970s, Charles Goyette helped thousands of investors get in on the ground floor.

In the 1990s, as U.S. stocks enjoyed one of their biggest rises in history, he helped investors take advantage of that boom as well.

And since the 2000s, the team he has assembled recommended 646 winning trades in gold, bonds, stocks and a variety of other markets.

Today, however, we have a totally different environment for two reasons:

First, the looming Fiscal Cliff — the largest-ever combination of federal tax hikes and spending cuts — could hit the economy like a ton of bricks starting January first.

And second, in a desperate attempt to soften the blow, the Federal Reserve has announced UNLIMITED money printing.

I know of few people more knowledgeable about BOTH the Fiscal Cliff AND the Fed than Charles Goyette.

So to get his latest insights about how these two dramatic events will impact markets during this heated political season, I just talked to him at length.

Here’s a condensed transcript of our interview …

The Simple Case for Gold : Interview with Charles Goyette

Martin Weiss: Good morning, Charles!

By announcing unlimited money printing, it seems Fed Chairman Bernanke is trying to fight the Fiscal Cliff single-handedly. Do you think that that can work?

Charles Goyette: Not a chance! Bernanke himself admits he can’t go it alone — that the Administration and Congress must reach a grand bargain on the Fiscal Cliff.

But they were unable to do so last year during the great budget ceiling battle. With just 54 days after the election, it’s highly unlikely they’ll be able to do so this year either.

Let’s face it: Unlimited money printing doesn’t stop the Fiscal Cliff, balance the budget or even do much for the economy.

Unlimited money printing means only one thing: Unlimited gold prices!

Martin: Some analysts seem to think that’s an oversimplification.

Charles: Quite to the contrary! Any second-guessing of this simple case for gold can only lead you to obfuscating the obvious and missing major profit opportunities.

Just connect the dots:

As the U.S. Fed prints dollars in unlimited amounts, it devalues the dollar.

As the European Central Bank prints unlimited amounts of euros, it devalues the euro.

As the Bank of Japan jumps in to print unlimited quantities of yen, it also devalues the yen.

And as these three major currencies go down, so do virtually all other paper currencies in the world.

Martin: There’s no way any paper currency can hold up with the word’s three most important currencies sinking in value.

Charles: Exactly! There’s only ONE kind of money they cannot devalue: Gold. As paper currencies fall, gold surges. No two ways about it.

Just look what Mr. Bernanke has ALREADY done:

* He has defied thousands of years of history — Rome before its collapse … Germany before World War II … Brazil in the 1960s and ‘70s … plus dozens of other rampant inflations.

* He has ignored evidence of rapidly diminishing returns for the economy — more effort, less impact.

* He has apparently overlooked new evidence of inflation — consumer and wholesale prices accelerating to the upside.

* And it looks like Mr. Bernanke has even rebuked his own experts, deciding to put the pedal to the metal with QE3.

At this rate, the Fed’s balance sheet will be about 24% of U.S. GDP by Christmas 2013!

So the scope of Bernanke’s money printing is breathtaking, and it’s being duplicated around the world. The European Central Bank is printing money, China is printing money, and now Japan as well.

It’s a global phenomenon moving at breakneck speed. And it’s lighting a fire under gold like none other in modern history.

Martin: When?

Charles: It has already started. Some wise investors saw that the Fed was going to embark on QE3. So they’ve been bidding up gold prices in the summer — in advance of the news itself.

But this is a lot more than QE3 — for several reasons:

First, like I said, it’s unlimited. QE1 and QE2 were capped. This one isn’t.

Second, for the first time, the Fed is targeting unemployment — not inflation. And we all know how tough it is to get unemployment down. After all — if the $1.8 trillion the Fed has already printed failed to solve America’s jobless problem, what makes anybody think another $40 billion a month can do the trick?

Third, it’s GLOBAL.

Plus, there’s one more joker in the deck — flight capital! The prospect that global investors will rush to gold in panic!

Martin: Hold on for a sec. If there’s a major calamity in Europe, wouldn’t some Europeans be forced to dump some of their gold to raise cash?

Charles: Of course. I’m not saying gold will go straight up. There’s always some vulnerability on the downside. But those are just interim moves.

For example, at some point, as things slow down in China, around the world, and particularly in Europe, we could again see some money rushing into the dollar, temporarily depressing gold. But if it happens, it will just be the prelude to the next gold price explosion.

The dollar is like the wooden shack at the beach. You’ve got a company picnic going on and it starts to rain. So everybody runs for cover under the shack. That’s the dollar.

But when the downpour turns into a massive hurricane, the shack is worthless, you want to be holed up in a house made of brick and mortar, something durable for the duration — gold.

Martin: For years, we’ve heard that only a small fraction of the world’s wealth is in gold. So if only a very small additional percentage of the world’s wealth shifts to gold, that alone would drive it through the roof.

For example, the U.S. mortgage market is four times larger than the gold market. The market for foreign currencies, most of which are being devalued, is 44 times larger. And the global market for derivatives is 500 times larger!

Charles: Agreed. Plus, here’s another stat for you: If a currency crisis drives each American to own just one ounce of gold, that’s 311 million ounces — enough to take down ALL of the world’s new gold mine production for almost 3½ years.

But that’s just U.S. citizens! The rest of the world’s gold demand will also surge in response to falling paper money.

And many people will want to own much more than a single ounce of gold as global money-printing goes into overdrive.

Martin: Is that also why gold has been moving up?

Charles: Hard to say. But for the most part, the American people are not yet gold buyers. Sure, they see a lot of gold ads on TV, but most have no experience with gold and don’t own any.

So just the prospect of more Americans moving into the gold market, each buying gold in very small amounts, leads to the conclusion that gold prices could balloon.

Martin: Typically it seems that there are big capital movements swinging back and forth between the euro and the dollar.

Charles: Yes, and when both currencies are devalued, then capital turns to the Japanese yen. But if Japan is also a locus of major money printing, the only currency left is gold. All the others are strictly irredeemable pieces of paper. This is obvious to us. Still, though, most average investors haven’t caught on yet.

Martin: So who is bidding up the price of gold?

Charles: Primarily some sophisticated and institutional investors. You have central banks moving into gold. They get it. You also have hedge funds beginning to understand it.

Consider Kyle Bass, currently on the board of the University of Texas as a financial advisor. He moved them into a billion dollars of physical gold. They actually took possession of the bullion — moved it to their own warehouse.

Martin: Earlier, you said that unlimited monetary expansion means unlimited gold prices. Can you expand on that?

Charles: With QE1 and QE2, the Fed knew that it was playing with fire — inflationary fire. It knew it was using a monetary weapon of mass destruction.

So by capping each QE program, the Fed was trying to assuage its critics. It was sending the message:

We know we’re committing a monetary sin, but at least we are exercising some semblance of restraint.

Martin: And now?

Charles: Now the Fed has abandoned its last vestige of restraint, effectively saying:

We have no clue what the consequences of unlimited money printing will be, but we’re going to do it anyhow!

Martin: This is ugly.

Charles: And it gets even uglier when you consider the ability of the U.S. to repay its debt.

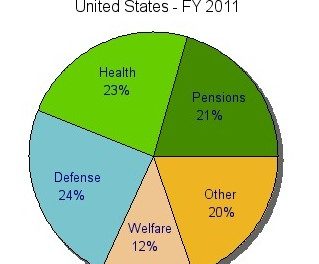

We all know about the $16 trillion national debt. But as Professor Kotlikoff at Boston University says, it’s not just $16 trillion. We have to also look at unfunded liabilities — things like Social Security and retirement plans that people in this country are counting on.

These unfunded liabilities aren’t just a number on a piece of paper. They’re real core debts and obligations that the U.S. has to retirees, veterans, Medicare recipients, and many other people.

So people ARE counting on them. Virtually every financial plan for individuals incorporates them. That’s one reason why they are very real and have a real impact.

Every business in America depends on its customer base, which, in turn, depends on its income. And that income relies on the government commitments to average Americans.

Professor Kotlikoff says the visible debt of $16 trillion is just the tip of the iceberg. The big part of the iceberg is below the waterline, and the total unfunded liabilities — what he calls the “fiscal gap” — is now $222 trillion!

Martin: More than ten times larger than funded debt!

Charles: Yes, and simply impossible to repay.

The ultimate arbiter — the final judge — of all this must be the price of gold.

Gold will respond to a double-barreled shotgun: BOTH the country’s massive debt load AND the Fed’s money printing.

The combination of these two is frightening. In fact, it’s precisely the same combination that doomed other countries to rampant inflation and ultimate decline.

It’s the same problem we’ve seen over and over again: Chronic insolvency covered up with massive injections of liquid cash.

Martin: Please sum it all up in just a few words.

Charles: Sure. The Fed’s unlimited money printing and the nation’s fundamental insolvency is creating a double calamity.

They’re pushing up the quantity — and pushing down the quality — of the U.S. dollar! Off the charts!

And this means gold should go off the chart to the upside.

It’s that simple.

Martin: Earlier, you told me that although you’re very bullish on gold, there are some things that investors need to know about before they load up on it.

Charles: Yes, the sheer popularity of gold — and its soaring price — have also created a new threat to anyone who already owns gold or plans to buy more in the near future.

Martin: So how can our readers protect themselves?

Charles: I just prepared a special report that details these new threats … and gives them three simple steps they can take to make sure their gold is protected forever.

Martin: Where can our readers find this report?

Charles: I just posted it online for free. They can access it right now by clicking here.