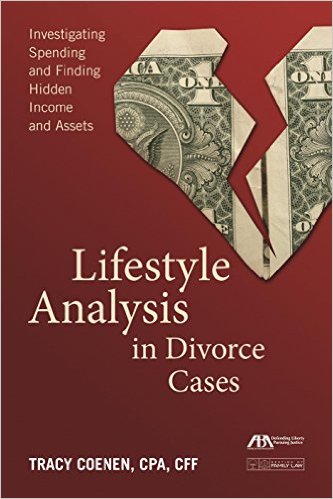

Author: Tracy Coenen, CPA

Author: Tracy Coenen, CPA

Publisher: American Bar Association – 204 pages

Book Review by: Sonu Chandiram

This is a very detail-oriented, well-organized, and well-written book on analyzing lifestyles and the spending that goes with it, and comparing that with declared incomes in tax returns and financial statements over the years, as well as looking for hidden assets – information that is highly useful for attorneys handling divorce cases.

To give you an overview of what you will find covered and discussed in this compact but concise handbook, we list below for you the titles of its 13 chapters:

- Purpose of the Lifestyle Analysis

- Standard of Living

- Defining and Calculating Income

- Preparing for the Lifestyle Analysis

- Financial Discovery

- Documents Used in the Lifestyle Analysis

- Financial Analysis of Documents

- Historic Spending and Budgeting

- Hidden Income

- Hidden Assets

- Special Items in Lifestyle Analysis

- Business Lifestyle Analysis

- Reporting Findings and Testifying

- Appendix A – Form 1040 and Schedule A

- Appendix B – Financial Discovery Checklist

- Appendix C – Allowable Monthly Living Expense National Standards (Effective 2013-04-01)

- Appendix D – Sample Net Worth Analysis

The author’s profile as described on Amazon indicates that she “has personally investigated hundreds of frauds in a wide variety of industries. Her work includes fraud examinations and financial investigations in cases of embezzlement, financial statement fraud, investment fraud, divorce and family law, and insurance fraud. She has served as an expert witness in numerous cases in state and federal courts involving damage calculations, commercial contract disputes, shareholder disputes and criminal defense.”

In today’s complex world of personal and corporate finance, experienced investigators are a must so that divorce cases are settled amicably and fairly. Tracy’s academic and work background, as well as her authorship of three books including this one on the subject, has equipped her well for the task of personal financial forensics. We highly recommend this excellent book.

Author:

Tracy Coenen, CPA, CFF is a forensic accountant and fraud investigator with Sequence Inc. in Milwaukee and Chicago, investigating embezzlement, financial statement fraud, securities fraud, Ponzi schemes, divorce, white collar criminal defense, insurance fraud, and civil litigation matters.

Her credentials include an Honors Bachelor of Arts in Criminology and Law Studies and a Master of Business Administration, both from Marquette University. Tracy is a Certified Public Accountant and is certified in Financial Forensics.

She is the author of three books, Expert Fraud Investigation: A Step-by-Step Guide, Essentials of Corporate Fraud, and The CPA’s Handbook of Fraud and Commercial Crime Prevention. Tracy has also authored several continuing education courses and hundreds of articles for attorneys and accountants.

Tracy has been an adjunct instructor at Marquette University, adjunct professor at Concordia University, and adjunct faculty member for the Association of Certified Fraud Examiners (ACFE). She was honored by the ACFE as the 2007 winner of the Hubbard Award. Tracy is a 2010 Marquette University Alumni National Awards winner, receiving the Entrepreneurial Award from the College of Business Administration.