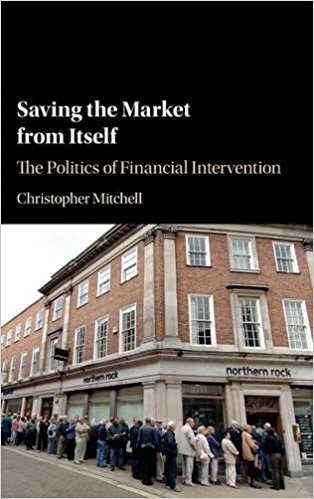

Author: Christopher Mitchell

Author: Christopher Mitchell

Publisher: Cambridge University Press – 244 pages

Book Review by: Sonu Chandiram

This book essentially provides a comparative analysis of the responses, and the results obtained from them, by Germany, the United Kingdom, and the United States, to the 2007-2009 financial crisis. This crisis was on a scale not seen since the 1930s Great Depression.

The response by the governments of all three countries was swift and bold, with sufficient cash to bail out the major banks. Since cash is the lifeblood of finance, it prevented a widely-feared devastation of the economic systems of these countries.

But the author Christopher Mitchell writes that the German response “was considerably more generous than the American and British bailouts were,” and it was not developed to recover a significant portion of taxpayer funds that were used to assist the banks. Nor did it actually do so.

The public, at least in the United States, is generally hostile to the use of taxpayer money to bail out banks. So the United States government designed its rescues in such a manner that it recouped most of the taxpayer money used to save the banks, and keep them alive.

The author interviewed primary sources in government, private firms, and in media to obtain the critical information for this highly insightful book. It is based on a combined framework of:

- Detailed case-study analyses of the three countries’ responses, and

- Quantitative analysis of patterns of state responses to financial crises

This outline below of the contents, including titles of its chapters, provides you a broad overview:

List of Figures and Tables

Preface

List of Abbreviations

- Introduction

- A Theory of Responses to Fiscal Crises

- Germany and the 2007-2009 Crisis

- The United Kingdom and the 2007-2009 Crisis

- The United States and the 2007-2009 Crisis

- Conclusion

Appendix

Bibliography

Index

Mitchell points out that while writers in academic and business literature had observed “an increasing convergence” in global financial and regulatory practices, his close study of these three and other countries’ response to the 2007-2009 financial crisis revealed “divergent” and sometimes “strikingly different policies.”

When starting his research for this book, he asked himself whether such different policies were simply because of the leaders’ different priorities and preferences, or were they driven by deeper structural forces?

He discovered that “even if divergent financial systems have moved closer together, they retain key differences, especially in the political clout of banks and bankers in times of crisis.” He also realized that “the extent of convergence has been overstated,” and financial crises “in fact reinforce diversity in national financial systems.”

In sum, Mitchell found out these important facts from detailed research and observations:

- The public is universally hostile to the use of taxpayer money in bailing out banks

- The governments of affected countries will invest significant amounts of money to contain financial crises

- The nature of the particular national financial system plays a key role in determining:

- The shape of the rescue

- The costs to shareholders

- The likelihood of the government recovering the bailout money

The various findings of the author pertaining to the 2007-2009 financial crisis as revealed in this important book can serve as a “look-back in the mirror” for the future on what to expect, avoid, and prevent, if possible.

History provides us lessons, and this book is a very valuable one in that regard. It is an outstanding one with excellent research data, organization and presentation of points, and synthesis.

Author:

Christopher Mitchell is a visiting assistant professor of International Affairs and Director of the International Trade and Investment Policy program at George Washington University in Washington, D.C.