by Martin D. Weiss, Ph.D.

Monday, June 4, 2012 at 7:30am

The countdown to the next Lehman-type event has begun …May 25, 2012 — the first major shock: Bankia, one of Spain’s largest banking conglomerates, reveals it needs an additional $23.8 billion to cover massive losses — money which the Spanish government simply does not have.

Result: Major bank runs, already under way in Greece and Spain, accelerate.

May 29 — the last nail in Spain’s coffin: Retail sales plunge 9.8%.

Result: This landmark event is expected to drive the country’s 24.4% unemployment rate to unheard-of levels.

May 30 — a new, unexpected element to the crisis: The world’s biggest trade credit insurer suspends all new coverage for anyone shipping goods to Greece.

Result: Key sectors of the Greek economy could be paralyzed, making it virtually impossible for Greece to meet its debt payments — despite all its bailouts.

June 1 (this past Friday) — the next big shock: the worst U.S. job numbers in a year.

Result: Suddenly, global investors begin to recognize what we’ve been saying all along — that this year’s U.S. “recovery” is a mirage.

The Dow plunges 275 points. Gold explodes by $60 per ounce. And the entire notion that the U.S. is a “safe haven” instantly evaporates.

Meanwhile, analysts estimate that, even without any further decline in its banking crisis, Spain could need a bailout of up to €450 billion ($560 billion), virtually wiping out Europe’s available bailout funds in one fell swoop.

And that’s not the worst-case scenario! In the midst of a banking panic and the resulting economic collapse, Spain could become a bottomless pit for which even $1 trillion would not suffice.

June 6 (the day after tomorrow) — The European Central Bank (ECB) meets in Frankfurt: They’re supposedly to decide what to do with interest rates, but more importantly, to come up with a scheme that somehow averts an all-out run on European banks.

Can they come up with a scheme to stem the flood of withdrawals? Perhaps momentarily. But here too, the dike has already been breached.

In fact, just in the first three months of the year, Spanish banks suffered net withdrawals of $121 billion.

And that was before the May 25th announcement of Bankia’s huge losses — a major blow to confidence of savers, prompting an even greater run on Spanish banks.

Exactly how much money are European savers pulling out of their banks in the wake of the latest upheavals? We’ll find out on …

June 11, precisely one week from today — That’s when the International Monetary Fund (IMF) issues its first report on European bank deposits since the latest phase of the crisis began to heat up.

So brace yourself! The IMF report could be a shocker, revealing massive withdrawals already under way … prompting even more bank runs … and making it virtually impossible for the ECB to stop the panic.

June 17 — Greeks go back to the polls.

If Greece’s anti-bailout leftist party wins, it sets off a rapid chain of events that culminate in the collapse of the euro zone.

And even if the pro-bailout centrist party somehow prevails, the chances that Greece will fulfill the Draconian terms of the European bailout are slim to nil.

When Does the Crisis Reach Critical Mass?

When Will It Precipitate a Lehman-Type Disaster?

It’s when the risk of still another, even more grandiose bailout is — or is perceived to be — far greater than the risk of the next big failure.

It’s when the authorities convince themselves they’ve built a strong enough firewall around the next failure that they can prevent the contagion from spreading.

It’s when the people who are asked to finance the bailouts throw up their arms in disgust and shout “Enough!”

As I showed you here last week, that’s precisely what happened in 2008 when Lehman went down. (See “Bank runs spreading across Europe! What next?”)

And it’s what’s beginning to happen again now in Europe. In Germany, the primary source of bailout funds, the public outcry against more rescue money for Greece or Spain is deafening. And throughout Europe, leaders are now talking far more seriously about letting Greece fail — much like U.S. authorities let Lehman fail four years ago.

The Next Big Question: How to Profit

No one can say exactly where the megashock will strike or what the precise impact will be. But we can look back at 2008 and map out the most likely sequence of events …

In the wake of the Lehman Brothers’ bankruptcy filing of September 15, 2008, credit markets froze up and banks virtually shut down all new lending.

Borrowing costs went through the roof. For most borrowers, money wasn’t available at any price.

The Dow lost nearly half its value in a matter of months.

Each of these market moves created major profit opportunities for investors using specialized instruments like inverse ETFs, designed to profit from market declines.

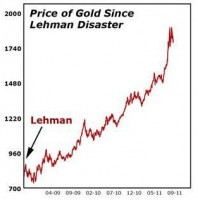

Plus, the Lehman failure had one more critical impact that was largely obscured in the shadow of the Dow: A short-term downturn in precious metals, followed by a massive long-term surge.

And therein lies one of the biggest profit opportunities of all.

Here’s why: Both gold and silver had started to react negatively to the financial crisis before the Lehman failure!

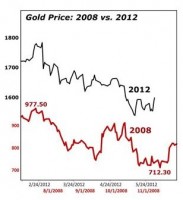

On July 15, 2008, gold was trading at $977.50, just $25 per ounce below the peak it reached in March.

But as debt crisis unfolded, gold began a four-month downturn, ultimately hitting a low of $712.30 on November 12 (red line on chart).

Why? Isn’t gold a safe-haven asset in times of uncertainty?

Yes.

But it’s also one of the assets that banks tend to liquidate when they need a quick cash infusion, and that’s exactly what happened in 2008.

Meanwhile, gold’s role as a safe haven was temporarily overshadowed by another safe-haven asset of choice — U.S. Treasuries.

So as global investors rushed to Treasuries, they had no choice but to buy U.S. dollars on the way, driving up the value of the greenback and driving down the value of contra-dollar assets like gold.

Sound familiar? It should.

Because the pattern in gold today is very similar: With the exception of Friday’s sudden surge, gold has been sliding for three months (black line on chart).

A coincidence? Not at all!

If anything, the similarity between then and now is another early warning that a Lehman-type megashock is about to throw the financial system back into turmoil.

For Most Investors, It Would Be Reason to Panic. But

For Smart Investors, It’s a Major Opportunity to Profit!

And in order to better understand that opportunity, you need look no further than the gold market after it hit bottom in November 2008.

That’s when the U.S. Federal Reserve was unleashing its first major wave of money printing in a desperate attempt to contain the fallout from the Lehman Brothers collapse.

That’s when gold embarked on a truly historic phase of its bull market, rising by $1,200 an ounce to a peak above $1,900.

And that’s when silver also enjoyed one of its most dramatic surges in history, rising from its 2008 low just below $9 an ounce to a high of $48.44, QUINTUPLING investors’ money.

How Much Longer Will Silver and Gold Decline This Time?

And Once They Hit Bottom, How Far Will They Rise?

For an answer, consider these facts: Today, entire nations are on the brink of failure — not just individual financial institutions. And these nations will typically stop at nothing to save themselves, especially rolling the money-printing presses.

- Today, the U.S. federal deficit is $1.327 trillion, 8.2 times larger than the deficit in 2007, the last full fiscal year before the Lehman collapse. Where are they going to get the money? Unabashed money printing seems to be the only answer they can come up.

- Today, the megabanks in danger — BNP Paribas, Barclays, Société Générale, Crédit Agricole, and many others — are far larger than the banks that failed or needed cash infusions in 2008. That means even BIGGER bailouts and far MORE money printing.

- Today, global central banks have already fired their biggest guns — stimulus plans, bailout deals, austerity measures — with only limited success. As a consequence, the only remaining device they know is … you guessed it! Pure and unadulterated money printing!

- Today, millions of citizens are rebelling at the polls — or in the streets — against new policy initiatives in France, Greece, Portugal, Spain, Italy, and even Germany. Result: Insatiable demands for even MORE paper money.

- And most important, the Federal Reserve, European Central Bank, Bank of England, and Bank of Japan have already embarked on the biggest orgy of money printing the world has ever seen. And they’re bound to push for more!

In sum, the next financial megashock could be larger, precipitating even bigger swings — and greater opportunities — in precious metals.

When all is said and done, investors may look back at these months and recognize, after the fact, it was the last great buying opportunity for precious metals of a lifetime.

Here’s what I recommend …

First, be sure to wait for the right time before loading up on precious metals. Remember: Even after a Lehman-type event, gold could continue to suffer a short-term correction.

Second, be sure to respond to the announcement as soon as you get it.

Third, no matter what, invest prudently, keeping a substantial portion of your money in cash.

Good luck and God bless!

Martin