Image Credit: Medium

Hyperinflation Is Here – You Just Haven’t Realized It Yet

Why saving is more important in 2021

There’s one noticeable trend among the rich right now: they’re spending more money on assets.

Bill Gates, Warren Buffet and Michael Burry (the legendary hedge fund manager who predicted 2008’s housing crisis) are buying farmland. Mark Cuban and Chamath Palihapitiya are buying crypto art or NFTs. Peter Schiff is buying gold. And Elon Musk and Cathie Wood are betting heavily on Bitcoin.

“I’m interested in finding investments that aren’t just simply going to float up and down with the market…The incredible correlation that we’re experiencing — we’ve been experiencing for several years — is problematic.” — Michael Burry

The rich are making their moves. So what are you doing? Hopefully, not buying more liabilities than assets.

Calculating Your Net Worth

A dollar saved is a dollar earned, as my grandpa used to say. Savings, however, is by no means the end goal of personal finance. Buying assets like Bitcoin, precious metals or real estate are what actually protect you against inflation. Sorry grandpa.

In case you need a refresher: Inflation is a hidden tax on your money and it affects middle-class and poor people the most; the same group who are also the least financially educated. When there is more money — i.e. stimulus checks or money printing (brrzt) — but fewer goods, the value of your dollars goes down. One dollar = less stuff. Historically speaking, hyperinflation (which is far worse) has always happened after a large-scale traumatic event. You know something like an earthquake, a war…or, a pandemic.

Inflation = Less goods + more dollars

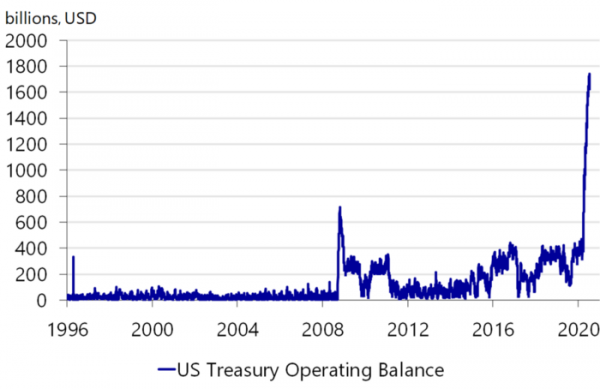

However, according to the Federal Reserve, there’s nothing to worry about. Inflation is a myth. A hoax. It’s the bogeyman. It doesn’t exist in 2021. In fact, inflation is lower than it was a few years ago at 2.26 percent. The Fed doesn’t want you to know they printed one-fourth of all U.S. dollars ever created last year alone. They don’t want you to know that Morgan Stanley is worried about a tsunami of inflation. They don’t want you to see this:

Your purchasing power is a dumpster fire right now. Accumulating more assets than liabilities isn’t a game; it’s your entire livelihood at stake.

I implore you, learn what your financial baseline is and calculate your net worth. It’s a great place to start.

Tally up all your savings + anything you considered an asset (car, laptop, stocks, and retirement accounts) and subtract it by your liabilities (debt, including student loans, mortgages, medical debt and back taxes). This is your net worth.

And this is what it should look like by age —

20 Years-old

Median Net Worth: $0 or less

Anything more than a $0 net worth around 20 means you’re doing better than most of your contemporaries. Why’s that? Simple, student loans, better known as indentured servitude.

You cannot declare bankruptcy on your student loans, so not being able to pay them will fuck you entirely. It’s indentured servitude. There’s nothing you can do except pay them down.

Hopefully my generation is the last that is swindled by 4-year institutions.

*By the way, we’re looking at median net worth’s not averages; because averages are skewed by extremely wealthy people (for example the average net worth for 50-year-olds is one million dollars, while the median is $200,000).

Actions to take

First, build good credit by paying off your student loans on time and not borrowing more than you need. Determine what is an asset in your life and what is a liability (Stocks=asset, Financing a new 2021 car=liability)

Second, invest in a retirement account like a Roth IRA which you can withdraw from tax-free when you’re older.

Third, begin investing in some sort of market whether that is crypto, stocks, or precious metals. The compound interest on these accounts will multiply the sooner you start investing. Think of these assets as your new money. Your dollars aren’t going away; you’re just boosting them with steroids.

Fourth, invest in your financial literacy. Books like “The Bitcoin Standard, Rich Dad, Poor Dad, and the Dollar Crisis,” have rewired my approach towards money. (Good books=assets)

30 Years-Old

Median Net Worth: $13,900

Hopefully, by now you have your student loans better under control. If not, don’t worry; be happy, because the median net worth of most 30-year-olds is only a few thousand dollars.

However, after this period it will be much MUCH harder to build your financial bedrock. The moves you make in your 20s and 30s will determine a great deal of your financial success.

“An important key to investing is to remember that stocks are not lottery tickets” — Peter Lynch

Actions to Take

First, aim to build a credit score between the ranges of 700 to 750. Try to pay off your credit card statement at the end of each month.

Second, make contributions to your 401(k) or Roth IRA. And recognize the important tax breaks that come with these accounts as well as employer matching.

Third, learn the difference between BAD and GOOD debt. Bad debt is buying things you don’t need like lottery tickets. Good debt is using credit to purchase more assets like Ethereum. Eliminate all bad debt in your 30s (or at least try).

And fourth, don’t just save — invest. It’s worth reiterating.

40 Year-olds

Median Net Worth: $140,000

This is where compound interest becomes your best friend. Simply making the decision to invest whatever you could in your 20s and 30s will pay off big in your 40s; even more so in your 50s. That’s it, one decision, just invest.

At this point, you should have 3X your annual salary saved and invested.

Pro Tip: While your investments may fluctuate negatively throughout the year, simply holding out — or holding as it’s known in the crypto community — almost always guarantees you a good return. It’s the best investment strategy.

Remember that no matter what age you are, prudence matters. It always matters. As Homer Simpson once said after downing a jar of mayonnaise and vodka:

“That’s a problem for future Homer. Man, I don’t envy that guy.” Be less like Homer Simpson.

Actions to Take

First, as you head into your 40s do not feel obliged to splurge your money on big events like larger-than-life weddings or an overindulgent house. Take a page out of

’s playbook; live low-key.

Second, understand that your net worth will not drastically change from here on out. The financial decisions you made leading up to this point aren’t final, but statistically speaking, are generally immutable.

Third, max out your retirement accounts every single year. Be prudent.

50 Years-old+

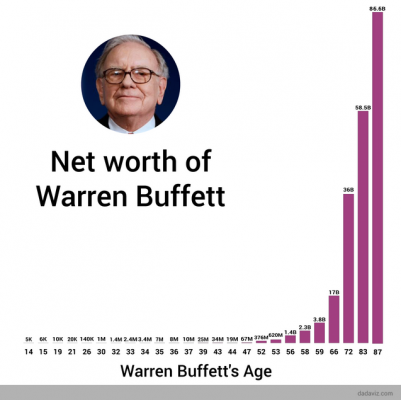

Median Net Worth: $168,000. Warren Buffett made 99.7% of his money after the age of 52.

He makes this chart a lot of fun —