By Jack Fersko | Gteenbaum, Rowe, Smith & Davis

By Jack Fersko | Gteenbaum, Rowe, Smith & Davis

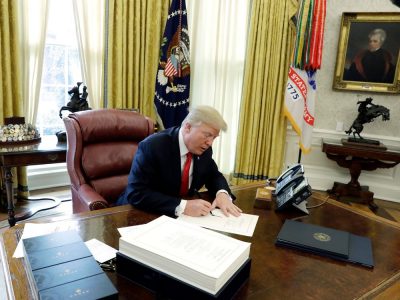

Woodbridge, NJ, April 24, 2020 – President Trump today signed the Paycheck Protection Program (PPP) and Health Care Enhancement Act into law. The legislation allocates $484 billion in additional economic stimulus funding, the majority of which will be allocated to the PPP established under Title I of the CARES Act.

The initial round of funding for the PPP was quickly exhausted. Following significant discussion and political developments, Congress passed this latest round of stimulus financing. Critical for small businesses is the $310 billion in additional funding for the PPP, which provides small business loans that can be forgiven if used for wages, benefits, rent and utilities. $60 billion of the new funding has been set aside for small lenders.

In addition, the newly signed bill authorizes funding for Small Business Administration (SBA) disaster assistance loans and grants, including the Economic Injury Disaster Loan (EIDL) program. The legislation also authorizes funding for hospitals, healthcare providers and expanded COVID-19 testing.

Although we will provide a more detailed analysis of funding opportunities under the new legislation in the next few days, we wanted to alert you to this breaking development immediately.

In light of how quickly PPP funding was exhausted during the initial round, it is critical that those who wish to participate in the program coordinate immediately with their counsel and lender to complete and file their loan application in order to advantageously position their application in the funding queue.

Our firm has been closely following all developments related to the PPP loan program in order to provide the most up-to-date information available. Please contact the author of this Alert, Jack Fersko, at: jfersko@greenbaumlaw.com | 732.476.3354 with questions or for assistance in evaluating your specific needs. Mr. Fersko is Co-Chair of the firm’s Real Estate Department.